It’s the number one question patients ask us after a car accident: “How am I going to pay for this?”

If you live in New York, the answer is likely “No-Fault Insurance.” But there is a catch.

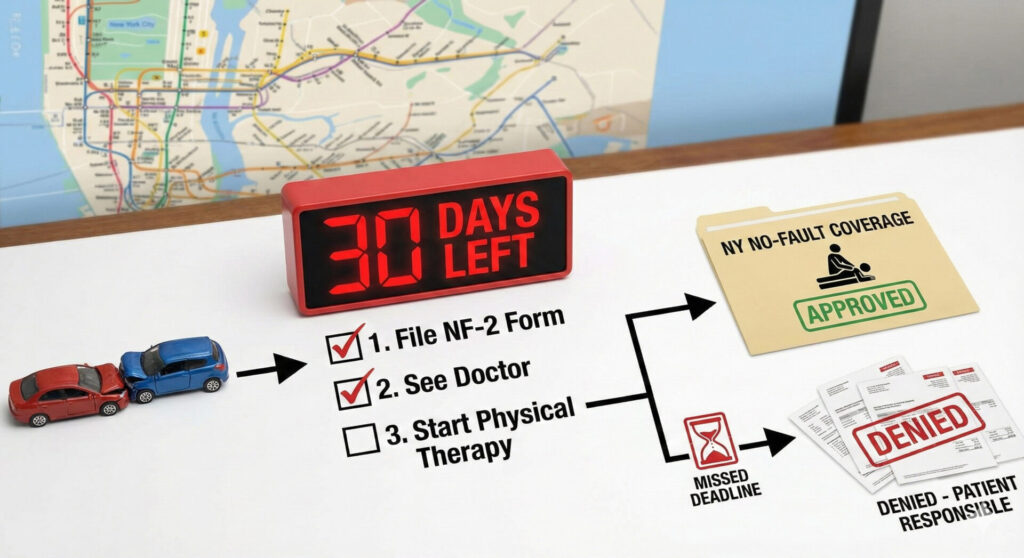

New York has some of the best accident coverage in the country, but it also has one of the strictest deadlines. If you miss the 30-day window to file your paperwork, you could lose your medical coverage entirely.

At CT Physical Therapy Care in Woodside, Queens, we help patients navigate this system every day. We don’t just treat your injuries; we help you protect your rights to care. Here is everything you need to know about getting your Physical Therapy covered.

What Is “No-Fault” Insurance?

New York is a “No-Fault” state. This means that after a car accident, your own car insurance pays for your medical bills, regardless of who caused the crash.

It doesn’t matter if you were rear-ended on the Grand Central Parkway, if you hit a pole, or if you were a passenger in a friend’s car. The insurance of the car you were in (or struck by, if you were a pedestrian) is responsible for your medical care.

It is important to understand the difference between the two types of mandatory coverage:

No-Fault (PIP) Coverage: This pays for you and your passengers, no matter who was at fault. The mandatory minimum coverage is $50,000 per person.

Liability Coverage: This pays for damage you cause to other people and their property. The NY DMV requires minimums of $25,000 for bodily injury and $10,000 for property damage. This does NOT pay for your physical therapy.

This $50,000 bucket covers:

- Ambulance and ER visits

- Doctor examinations (Ortho, Neuro, etc.)

- Physical Therapy (to treat whiplash, back pain, and injuries)

- Lost wages (80% of earnings, up to $2,000/month)

- Prescriptions and diagnostic tests (MRIs, X-Rays)

The Critical Deadline: The 30-Day Rule

Here is where most people get into trouble. To activate this coverage, you must file a specific form called the NF-2 (Application for Motor Vehicle No-Fault Benefits) with the insurance company.

You have exactly 30 days from the date of the accident to file this form.

If you wait 35 days because you “thought the pain would go away,” the insurance company can (and often will) deny your claim. This delay means you would be personally responsible for all your medical bills.

Pro-Tip: Do not wait until you are in severe pain to file. Even if you feel “okay” right now, file the form to protect your right to treatment later. It is better to file a claim and not use it than to need care later and be locked out.

Missed the Deadline? Don’t Panic (Yet)

If you are reading this on Day 35 or Day 40, do not give up.

You can still file a claim, but the rules have changed. Under New York law, insurance companies can accept a late application if you have a “clear and reasonable justification” for the delay.

However, do not try to do this alone. If you file late without a proper legal explanation, you will almost certainly get denied.

You must consult a No-Fault lawyer immediately. An experienced attorney can help you write a letter of justification. Valid reasons often include:

- You were hospitalized or physically incapacitated.

- You were given incorrect insurance information at the scene.

- You had difficulty identifying the correct insurer (as is common in hit-and-runs).

Bottom Line: If you are late, stop reading and call a lawyer. Then, contact us to start your care.

Crucial Detail: Who Do I Send the Form To?

This issue is where 50% of people make a mistake. You do not always send the form to your insurance agent. You must send the NF-2 form to the insurance company of the car you were in at the time of the crash.

- If you were driving your own car: Send it to your insurance carrier.

- If you were a passenger in a friend’s car: Send it to their insurance company (not yours).

- If you were a passenger in an Uber/Lyft: Send it to the rideshare company’s insurer.

- If you were a pedestrian: Send it to the insurance of the car that hit you.

Warning: Sending it to the wrong company burns valuable time on your 30-day clock.

Does No-Fault Cover Physical Therapy?

Yes. Physical Therapy is considered a “necessary medical expense” under New York’s No-Fault law.

Because car accidents often cause “soft tissue” injuries—like delayed neck pain or nerve compression—that don’t always show up on X-rays, Physical Therapy is usually the primary treatment recommended by doctors.

However, to get covered, you need two things:

- A Prescription: You need a referral for Physical Therapy from a doctor (MD), Chiropractor, or Nurse Practitioner.

- Medical Necessity: The treatment must focus on helping you recover from the specific injuries caused by the accident.

3 Common Mistakes That Get Claims Denied

Even if you file on time, insurance adjusters look for reasons to limit payouts. Here are the three most common traps we see patients fall into:

1. The “Gap in Treatment” Trap

Suppose you see a doctor on Day 1 but don’t start Physical Therapy until Day 45. In that case, the insurance adjuster will likely argue your injury isn’t serious, or the accident didn’t cause it. Consistency is key. You need a continuous paper trail of care. Do not have significant gaps between appointments.

2. Conflicting Stories

If you tell the police your neck hurts, but tell your doctor your lower back hurts, the insurance company will flag the discrepancy. Be specific, honest, and consistent with every provider you see.

3. Skipping the IME

The insurance company may eventually ask you to see their doctor for an Independent Medical Exam (IME). If you miss this appointment, they can legally cut off your benefits immediately. Never skip an IME.

“What If I Have Private Health Insurance?”

Patients often ask, “Can’t I just use my Blue Cross or United Healthcare card?”

In New York, No-Fault is primary. This policy means that your providers must bill the car insurance first. Your private health insurance will generally deny any claims related to a car accident until your No-Fault benefits are exhausted (used up).

You cannot “choose” to use your private insurance just to avoid paperwork. You must go through the No-Fault system first.

How to Start Your Treatment in Queens (Step-by-Step)

If you have been in an accident in Queens (Woodside, Astoria, Jackson Heights, Sunnyside), here is your checklist to ensure your Physical Therapy is free of cost to you:

- File the NF-2 Form: Download it, fill it out, and mail it to the correct insurance carrier immediately. (We recommend that you send it by “Certified Mail” so you have proof of the date.)

- See a Doctor Immediately: You need a medical report linking your injury to the accident.

- Schedule a PT Evaluation: Call CT Physical Therapy Care. We accept No-Fault insurance and handle the billing directly with the adjuster. You focus on healing; we handle the paperwork.

Don’t Let the Clock Run Out

The biggest mistake we see is patients waiting 6 weeks to seek help. By then, the 30-day window has closed, and the insurance company may refuse to pay.

Action Steps:

- Download the NF-2 Form:

- Call CT Physical Therapy Care at 718-255-6229 to schedule your evaluation.

Your recovery is covered—but only if you act fast.